"I'm In My 40’s & 50’s"

Discover how we help good earners create long-term wealth and financial freedom through smart financial planning and advice.

NOTE:Download the full infographic featured in this post here.

Many Australians fall into the trap of earning good money without taking the time to stop and assess their long-term financial strategy. After all, when it comes to retirement planning, it’s important to remember that the little choices you make now can make a huge difference down the track when it counts – for better or worse.

There are lots of reasons why many Australians don’t properly plan for retirement. Maybe one or more are familiar to you:

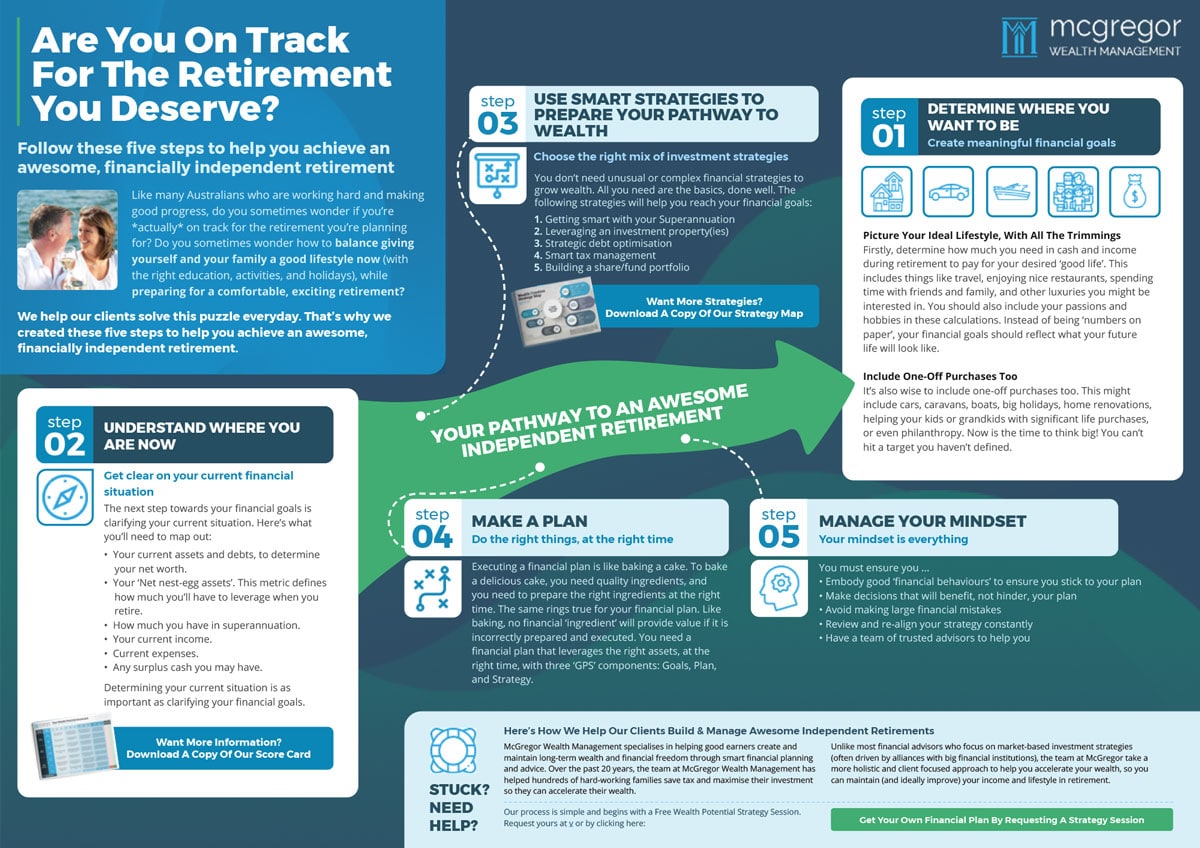

Many of our clients are surprised to hear that creating an Awesome Independent Retirement is much easier than they expect. All you need is the right strategy and carefully calculated execution. That’s why we created this five step process — to show you that achieving an Awesome Independent Retirement is as simple as following a proven formula.

=======================

Create meaningful financial goals

The first step towards an Awesome Independent Retirement is to determine what yours will ACTUALLY look like. After all, everyone’s retirement is different… and you’ll need to determine how much wealth you’ll need to bring it to fruition.

Planning an Awesome Independent Retirement is not as simple as jotting down a “dream annual income”. After all, it’s hard to really understand what that figure will mean in five or 10 years time (This is for two reasons: Your income needs might change, and economic inflation must be taken into consideration). Instead, picture your ideal retirement lifestyle.

Ask yourself:

I invite you to think big here. It’s important to create a connection with your retirement goals. It’s also important to remember that you’ll have more free time and may have to put aside more money for your hobbies and passions than you would have during your working years.

Factor In One-Off Purchases, Too

It’s important to factor in one-off purchases, as well. These may include cars, caravans, Harleys, boats, building your dream home, renovations, helping your kids or grandkids with significant life purchases, or even philanthropy.

Don’t forget that even in retirement, “life” happens. It’s important to have enough money put aside to comfortably tackle problems like your car breaking down, or an unexpected family crisis. Carefully planning for retirement means knowing you have this money put aside to comfortably weather any storm without it impacting your other plans.

=======================

Get clear on your current financial situation

(Download Your Score Card Here)

The second step is to get a crystal clear picture of where you are NOW. You won’t ever be able to build a realistic or actionable financial plan unless you have a clear and accurate understanding of your current situation.

In order to get a full understanding of your current financial situation, you’ll need to assess the following.

The total of your net worth will be your assets minus your debts, but it’s worth looking deeper into the figures than just that number.

It’s important to look not only at your net worth but also at how you’ve been tracking over time. For example, if you’ve noticed you’ve developed a pattern of consistently adding more debt to your portfolio with depreciating assets (for example, cars or boats) which isn’t being outpaced by your appreciating assets (for example, property and shares), you’ll need to factor in a strategy to address that as part of your financial plan.

Get a better understanding of your current situation by downloading our Score Card.

=======================

Choose the right mix of investment strategies

(Download Your Strategy Map Here)

You might be surprised to hear a financial planning firm tell you that the secret to retiring with a strong financial future isn’t actually all that complex. All that’s required is a combination of simple concepts, executed correctly.

Naturally, it’s smart to steer clear of get rich quick schemes, salespeople selling investment products that are too good to be true, and overly ambitious speculation on the share market. This is true at any stage of life but is particularly important in your later working years. Why? It’s not as easy to bounce back from financial mistakes… and making poor financial decisions can be disastrous.

Instead, stick to what works.

The most surefire way to build a strong retirement nest egg is to follow tried and tested strategies. We use following strategies to help our clients reach their financial goals:

Get more strategies by downloading our Strategy Map.

=======================

Now’s the time to pull the ingredients together. Executing a financial plan is exactly like baking a cake. You need quality ingredients, you need a tried and tested recipe and you need to add the right ingredients at the right time. Like baking, no financial ‘ingredient’ will provide value if it is added at the wrong stage, or not used correctly. Instead, you’ll risk turning all those carefully-prepared ingredients into disaster.

To get things right, you need a recipe that leverages the right assets, at the right time, with three “GPS” components: Goals, Plan, and Strategy.

Step four is all about putting the pieces in place in the right order, at the right time. That may involve acquiring an investment property, or it may involve restructuring your existing debts*.

It may involve jumping into the sharemarket, or moving your existing share portfolio over to a lower-risk option*.

Whatever you’re aiming to bake with your recipe, this can be an exciting time.

When you take these steps, you’re effectively locking in your investment strategy for the future. And, if you’ve done your due diligence by following the steps above (with a bit of expert help), you should be well on your way to an Awesome Independent Retirement.

That’s definitely something to be excited about.

*This is general advice only.

=======================

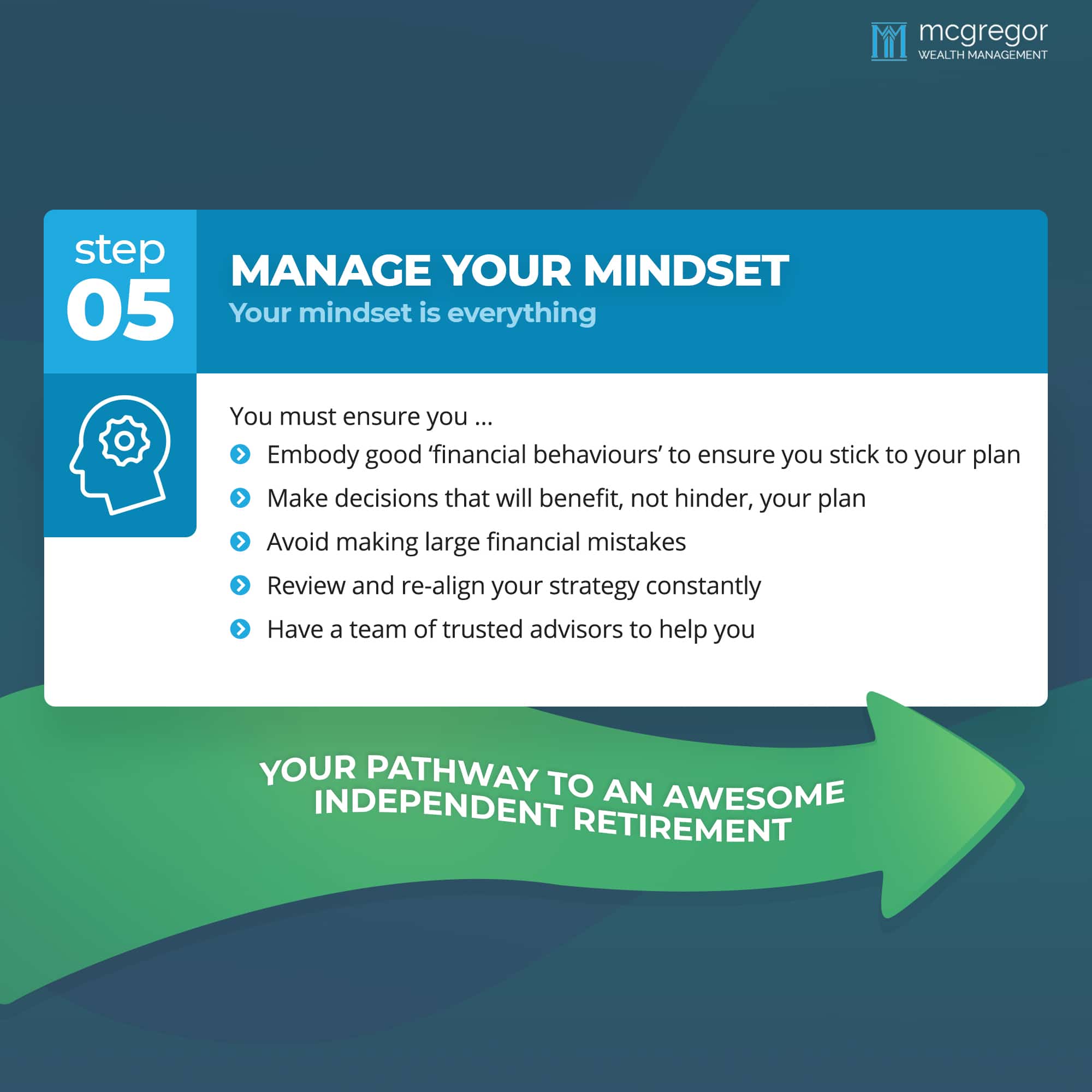

Your mindset is everything

Alright, you’re nearly there. But it’s really important that you master this final step too. Managing your mindset is crucial if you REALLY want to live out the vision you outlined in step one.

Remember the cake we baked in the last step? Well, if you leave it out in the rain all your good work will come undone…

Putting in place a financial strategy is no good if you treat it as a “tick box” on your to-do list and promptly forget about it days or weeks later.

Good financial management takes ongoing work and just a little bit of discipline (although, at McGregor Wealth Management, we make sure we don’t make it too arduous).

To make sure your financial vision comes to life just how you wanted, you’ll need to do the following:

If you need help at any stage of your planning process, feel free to contact the team at McGregor Wealth Management.

—–

McGregor Wealth Management specialises in helping good earners create and maintain long-term wealth and financial freedom through smart financial planning and advice.

Over the past 20 years, the team at McGregor Wealth Management has helped hundreds of hard-working families save tax and maximise their investments so they can accelerate their wealth.

Unlike most financial advisors who focus on market-based investment strategies (often driven by alliances with big financial institutions), the team at McGregor take a more holistic and client focused approach to help you accelerate your wealth, so you can maintain (and ideally improve) your income and lifestyle in retirement.

Our process is simple and begins with a Free Wealth Potential Strategy Meeting. Request yours here.