"I'm In My 40’s & 50’s"

Discover how we help good earners create long-term wealth and financial freedom through smart financial planning and advice.

If you’re like many ambitious self-funded retirees and good income earners, you’ve probably dabbled in self-driven investing in some way or another. Maybe you’ve bought shares, or invested in an ETF, or bought cryptocurrency, or tipped some cash into a left-field investment vehicle… or maybe you’ve done all of the above.

Regardless, I suspect you’ve had mixed results from your journey so far: maybe it’s going “OK”… or maybe things haven’t perform as well as you had hoped, leaving you with a handful of introspective questions.

As such, some of the questions we’re often asked by new and existing clients are:

Does “good” investing have to be complex?

And…

Do I need to choose advanced and/or complicated investments to create growth and income from a portfolio?

These are great questions, because they allow me to explain one of the biggest problems in the investment industry, which is this:

In reality, “good” investing does not have to be complex nor complicated. Good investing—where a portfolio provides stable growth and income where needed—can be achieved with a simple but carefully chosen set of investments. In this case “simple is sophisticated” is a theme we weave in to almost all of our clients’ portfolios, and it works well for them.

A such, the real question is this:

“Why do many investors believe that good investing should be complex?”

Here’s the root of the problem: there are three high-powered stakeholders vested in keeping investing “confusing”, so that the general population continues to rely on them as viable investment choices. As I’ll explain further down, these stakeholders have an interest in ‘teaching’ the general population that they must be constantly buying and selling if they want to see significant growth… which leads to a negative effect over time. Those three stakeholders are:

Big banks and big insurance companies generate substantial profits by selling investment products to the general population. The results of the Financial Services Royal Commission gave a shocking insight into this paradigm. It’s important to note that since the Royal Commission, a lot has changed—however these organisations still have an interest in selling their products. Keeping investing “confusing” helps them achieve this.

(Quick note: Please don’t get me wrong: this is not to say there’s not great people working in those companies, but the machine itself has done a lot of damage to a lot of people.)

At the other end of the spectrum, we’ve got the seemingly “safe and simple” industry superannuation funds designed for people who don’t want to get financial advice and also want to avoid the big end of town.

Industry super funds are a good “easy” option, but they’re often not very transparent. In most cases these funds are more suitable than the investment choices offered by big banks and insurance companies, however they can be restrictive if you’re looking for ways to expand a portfolio.

Thirdly, we have the investment action industry—entities like stockbrokers, investment tip newsletters or websites, or other communications that promote action around “hot stock tips” (eg. “Buy this, sell this, buy CBA, sell Westpac, buy BHP, sell Rio Tinto, etc.”). Key players in the investment action industry are often motivated by an economic model of being paid by an ‘action’ eg. via a transaction commission or a paid subscription, which has the side effect of ‘teaching’ self-driven investors that they must be constantly buying and selling if they want to see significant growth.

The final and most compounding stakeholder is the media. Never have the media had to fight so much for the attention of the general population, and they’re doing this by being 100% negative, or at least 90%, negative for most of the time. One of the ways in which they do this is by negatively portraying the investment industry… which, again, has the side effect of ‘teaching’ self-driven investors that they must be constantly buying and selling if they want to see significant growth.

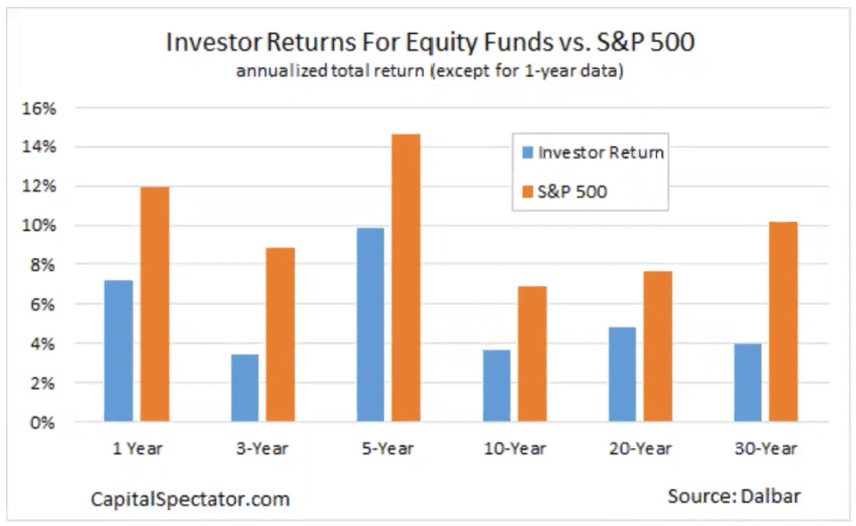

The biggest cost of being passively taught to constantly “buy and sell” investment options can be examined in fascinating research called the “Dalbar” study.

Over a period of 14 years, the Dalbar study has compared:

Here’s the interesting part — the returns that investors get are LESS than the returns their investments get. Why? Their behaviour, including:

… all of which adds up into a reduced longer-term benefit as seen in the chart here:

A quick analysis:

Investing does NOT have to be complicated to be fruitful. Often, the best investment plan is just a simple strategy executed with a high degree of quality.

Over the past 20 years, the team at McGregor Wealth Management has helped hundreds of hard-working families accelerate their wealth.

Unlike most financial advisors who focus on market-based investment strategies (often driven by alliances with big financial institutions), the we take a more holistic and client focused approach to help you accelerate your wealth, so you can maintain (and ideally improve) your income and lifestyle in retirement.

Our process is simple and begins with a Free Wealth Potential Strategy Meeting, during which…

Although many participants realise there is a ‘gap’ between where they are currently, and where they’d like to be, they are relieved to discover there is a realistic way to close the ‘gap’ and achieve a more exciting ‘wealth potential’.

By simply going through this exercise, many people feel more in control of, and optimistic about, their financial future.

To explore how we can help you understand your wealth potential, get in touch to arrange a Free Wealth Potential Strategy Meeting.