"I'm In My 40’s & 50’s"

Discover how we help good earners create long-term wealth and financial freedom through smart financial planning and advice.

Learn More

We have been helping clients on the Sunshine Coast and around Australia

(plus a few overseas) since the year 2000.

We’re passionate about creating “Awesome Independent Retirements” for our clients. However, like many new clients we speak with, you might be wondering two things:

These are great questions. Let’s look at each one:

Independent Retirees are everyday Australians who, using their retirement assets, fund all or part of their retirement. Generally speaking, we categorise self-funded retirees into one of three groups…

An “Awesome Independent Retirement” happens when you have the ability to do the things you love when you retire and aren?t worried about money restraints holding you back.

To be more specific, there are FOUR things I ensure help our clients achieve when they experience their Awesome Independent Retirement?

We have found that people live happier and more fulfilled lives with more confidence, security and peace of mind when they know they are:

It gives us great satisfaction to helping our clients get to and maintain this position throughout their lives.

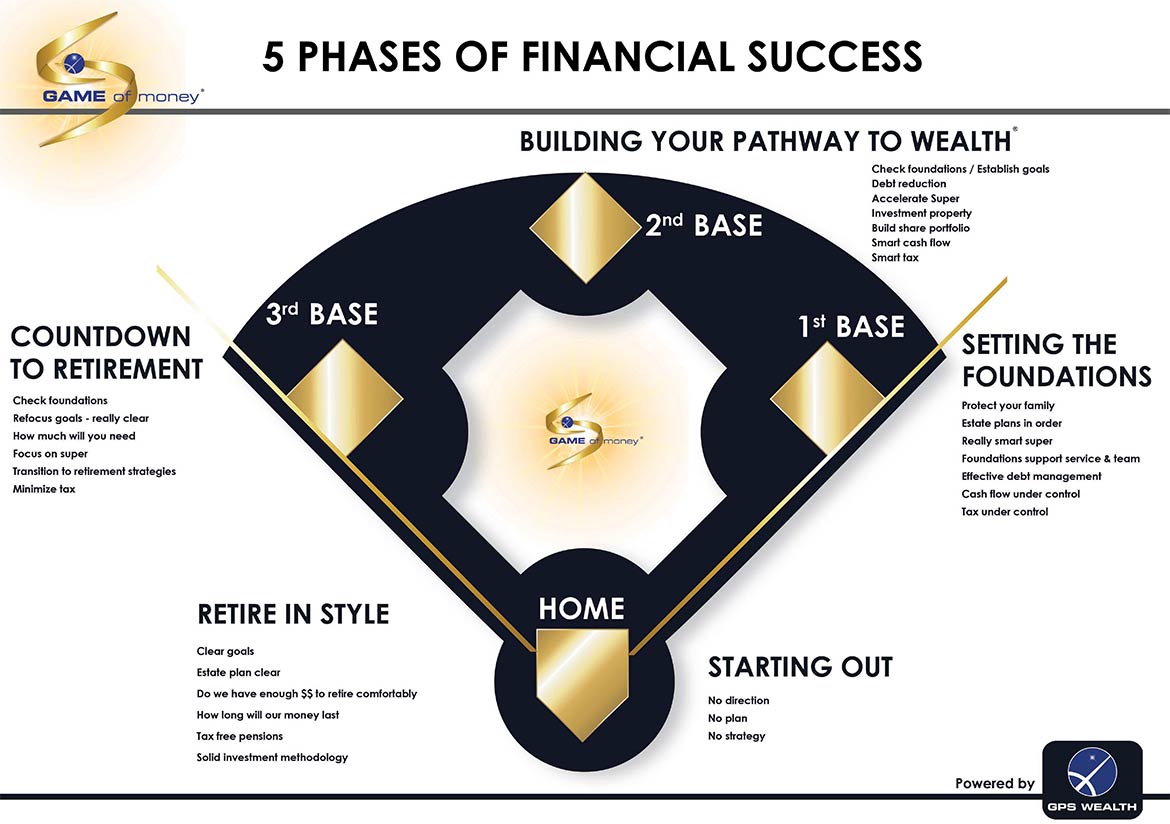

We love simplifying financial concepts. Together, we’ll use our “Game Of Money” model to determine exactly where you are in your journey to financial freedom… and where you need to move towards to create an awesome independent retirement.

We all want an Awesome Independent Retirement. But unfortunately, far too many Australians are not making the right decisions today, which will undoubtedly hurt them down the track.

Don’t worry, this isn’t completely your fault. The reality is that many financial planners don’t actually do any financial planning. In fact, you’ve probably already come across the ‘financial industry triads’— the big banks and insurance companies with their armies of salespeople dressed up as financial advisors or financial planners trying to sell their products. It might sound counterintuitive, but some financial planners are simply ‘investment sales people’ posing as planners.

The role of a REAL financial planner is to firstly, understand what you want to achieve, then map out an actual, actionable plan to get you there. We call this ‘real financial planning’ and it is all about getting a clear picture of your circumstances and building smart strategies to help you reach your financial goals.

To get a better understanding of what ‘real’ financial planning looks like, we can break it down into seven key elements.

Like many people new to our website, you’re probably not ready to work with us just yet. And that’s completely understandable. Why not get to know us by downloading or watching some of our free content?

I knew we needed a clear and straightforward plan that focused on our specific goals. Without going through the goal setting process, I think we would have continued with ad hoc investing that reacted to markets, instead of having a very specific plan. Once everything is set up, the process really is set and forget. We have 2 simple goals: to retire “on time” with our goal retirement funds behind us; and to continue investing to support our income goals. Both of them are on track!

I have found Rob and his team exceptionally insightful and valuable in their down-to-earth and strategic advice over the past 13 years — and they keep getting better and better. I give them my highest recommendation!!!

Rob has successfully managed the transition from our working lives to us becoming comfortably retired. During our over a decade long association as clients, Rob and his team presented a thoroughly professional, optimistic and supportive program on behalf of his efforts to represent us.

We always put the “investment strategy” off as we were busy trying to pay off our mortgage and believed no debt is the best debt. That quickly changed when were in a position to sell our small business and we needed smart advice. We went from have negligible savings to having our future secured within 6 months. Overall, we’re extremely happy with our strategy and can see gains as expected.

Discover how we help good earners create long-term wealth and financial freedom through smart financial planning and advice.

Learn More

Retiring soon? This is a critical time. Find out how we help pre-retirees take the smartest steps towards their retirement.

Learn More

Find out how we help self-funded retirees get more money AND peace of mind during retirement, without the hassles, headaches or silly risks.

Learn More General Advice Warning

The information contained on this website has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs. You should, before you make any decision regarding any information, strategies or products mentioned on this website, consult your own financial advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs.

Discover how we help good earners create long-term wealth and financial freedom through smart financial planning and advice.

Retiring soon? This is a critical time. Find out how we help pre-retirees take the smartest steps towards their retirement.

Find out how we help self-funded retirees get more money AND peace of mind during retirement, without the hassles, headaches or silly risks.

Almost there: please complete the form to request your…

With A Senior Adviser

From McGregor Wealth Management

Nearly there: please complete your email and let us know where to send your Independent Retirees Report:

Discover How To Avoid The 10 Surprising Dangers That Threaten To Erode Your Retirement Savings…

Nearly there: please complete your email and let us know where to send your Free Video Series:

Discover how to build wealth and achieve your Wealth Potential via this detailed case study video series…